Get the big picture with this free personal financial management tool. See all of your financial accounts, balances, and transactions in one place — plus, track expenses and create budgets — all conveniently and securely within online banking.

Money Management aggregates over 10,000 financial institutions and we add more every month. Account aggregation gathers basic financial information from all of your different financial institutions and organizes it into one place.

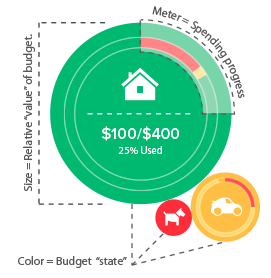

Bubble Budgets

Visualize and interact with your budgets in a more meaningful way — using bubbles that allow you to quickly identify budgets that need the most attention.

Expense Tracking

Get powerful insights on where, when, and how you spend. Money Management automatically categorizes and tracks spending from all your accounts, so you can see where your money is really going, giving you in-depth insights into your spending habits.

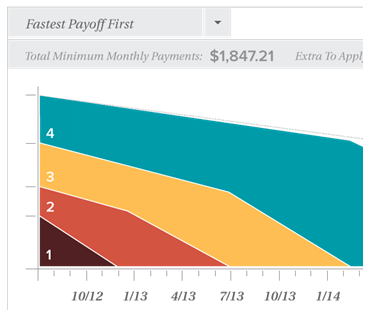

Debt Management

At some point in our lives, most of us have borrowed beyond our means. If you're in over your head, Money Management is designed to give you step-by-step instructions on how to get out of debt, and stay out for good.

Net Worth

Net Worth shows you a contextually accurate data visualization of your assets vs. liabilities. Quickly determine if you are moving in the right direction — and to what degree.

Security

We are committed to confidentiality, integrity, and security. With that in mind we've integrated Money Management into your online banking to ensure that your sensitive information is protected with the highest of security standards.

How to Get Started

- Set up your account: Log in to your online banking and click the “Manage Money” link in the top navigation. Your Envista account will automatically begin syncing to Money Management.

- Add all accounts: See your full financial picture by adding accounts with other financial institutions. Add manual accounts for property, like homes or vehicles.

- Categorize transactions: After all of your accounts have been added, open the Transactions View and review your transactions for accuracy. Transactions are automatically categorized for you, but they are not always accurate and may need to be re-categorized. Your changes will be applied to future transactions.

- Create budgets: With your transactions correctly categorized, you can easily create budgets based on your actual spending history. Open Budgets and follow the instructions to generate a budget.

If you need assistance, please contact us or call 785-228-0149.